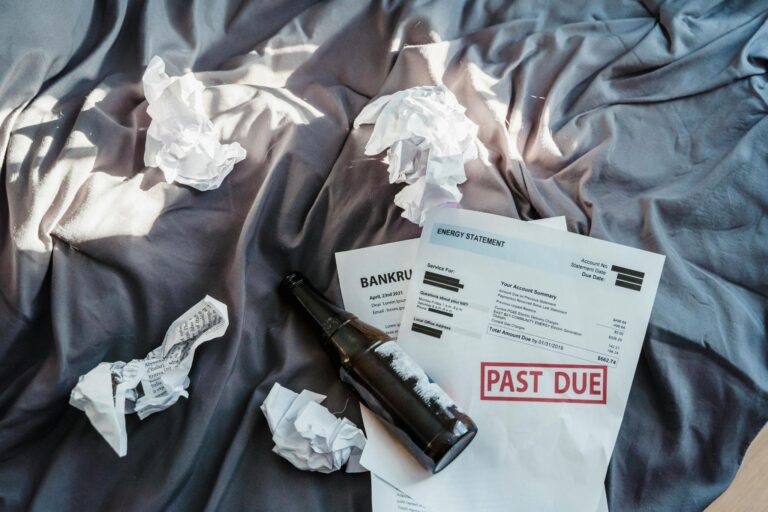

If you’re thinking about filing for bankruptcy or you’ve already taken that step, one of your biggest concerns is probably your money, especially what’s sitting in your bank account. Can you still use it? Will it get frozen? What about that check you just deposited?

These are real worries for anyone going through a financial reset. But the truth is, you don’t lose access to everything the moment you file. It’s just a matter of knowing what to expect. This guide walks you through what can happen to your bank accounts during bankruptcy—and what you can do to protect yourself.

What Filing for Bankruptcy Means for Your Bank Accounts

When you file for bankruptcy—whether it’s Chapter 7 or Chapter 13—your financial situation changes, but your bank account doesn’t just disappear. Still, access to your funds might be affected depending on your circumstances.

Chapter 7, often called a liquidation bankruptcy, may involve selling certain assets to repay creditors. Chapter 13 works differently. It sets up a repayment plan where you pay back a portion of your debt over three to five years.

In both types, a bankruptcy trustee is assigned to review your financial details, including what’s in your bank accounts. If your balances are over the exemption limits allowed in your state, the extra funds could be taken to help repay debt. But if you’re within those limits, you typically get to keep that money.

Some banks may freeze your account temporarily, especially if you owe them money on other products, like credit cards. While that doesn’t always happen, it’s something to be aware of.

Timing also matters. If you recently deposited a check, the money might not be available right away. Factors like the check’s amount, the deposit method, and your bank’s policies can all affect deposit check time, and that short delay could be important when every dollar counts.

Can You Still Use Your Bank Account After Filing?

In most cases, yes, you can still use your bank account after filing. Your debit card should still work. Online banking typically remains active. But again, it depends on your bank and whether they choose to freeze your account temporarily.

If your account is at a bank where you also have debt—like a personal loan or credit card—they may place a hold while your case gets reviewed. That’s why some people choose to open a new bank account at a different institution before filing, just to be safe.

Either way, it’s smart to keep some cash on hand during the first week or so, just in case there are any delays in accessing your money.

What Happens to Joint Accounts?

Joint accounts bring another layer of complexity. If you share an account with a spouse, parent, or anyone else, that account is considered part of your assets when you file for bankruptcy, even if the other person doesn’t file with you.

The bankruptcy trustee will still review the full balance. They may assume that half the money belongs to you, even if you didn’t contribute to it. That can create issues, especially if the other person depends on that money.

Because of this, it’s often recommended to avoid sharing accounts close to your filing date. If you’re already in a joint account, be prepared to show where the money came from. Clear records can help avoid misunderstandings.

How Exemptions Work with Bank Balances

Every state has exemption rules that protect some of your assets, including money in the bank. These rules vary depending on where you live. Some states offer a specific dollar amount you can keep in your account. Others provide a “wildcard” exemption that you can apply to anything, including cash.

Let’s say your state protects $2,000 in bank funds. If your checking account holds $1,500, you’re in good shape. But if you have $5,000 in there, the trustee may seize the extra $3,000 to pay creditors—unless you can apply other exemptions to cover it.

It’s important to know these limits before filing, so you’re not surprised. A bankruptcy attorney can help you figure out how your state’s laws apply to your situation.

Tips for Managing Your Accounts During the Process

Keeping your financial activity clean and simple during bankruptcy is key. Here are a few tips:

- Monitor your balances daily, especially right after filing, so you don’t miss any unexpected changes or account holds.

- Don’t transfer large sums between accounts unless absolutely necessary. That could raise red flags with the trustee.

- Avoid cashing in on assets or making large deposits without talking to your lawyer first to avoid delays or complications.

- Keep clear records of where your money comes from and where it goes, including receipts and statements.

Staying organized helps your case go smoother and prevents problems with the trustee.

Should You Open a New Bank Account?

Sometimes it makes sense to open a new account, especially if your current bank is one of your creditors. This can help avoid account freezes or holds. Just remember: you must still report this account to the bankruptcy court and trustee. Nothing is truly “off the radar” during bankruptcy, so always be transparent.

A new account can also help you keep your bankruptcy finances separate from any future income, which is helpful for budgeting and staying on track.

Bankruptcy can feel overwhelming, especially when it comes to your money. But knowing what happens to your bank accounts—and what to expect—can make the process easier to manage. Most people are able to keep their checking and savings accounts with little disruption, especially if they plan ahead.

If you’re concerned about how your current funds will be treated or how long it will take for recent deposits to be available, don’t be afraid to ask questions. Get familiar with your bank’s policies, and talk to your attorney about your options. With the right guidance, you can take control of your finances and start fresh, without losing access to the essentials you rely on every day.