Navigating the fire damage insurance claim process for your home can be really overwhelming. When your home suffers fire damage, knowing the next steps is important. This guide will help you understand the process, from reporting the damage to getting your payout.

Following these steps can make the whole experience less stressful and ensure you get the help you need. Let’s dive in and get started on making things right again.

Ensure Safety First

Before you start the fire damage insurance claim process, make sure everyone is safe. Check that there are no injuries and that everyone is out of the house. Do not go back inside until the fire department says it is safe.

If there is still smoke or heat, stay away from the area. Make sure to wear protective gear like gloves and masks if you must enter. Safety comes first when dealing with fire damage.

Contact Your Insurance Company

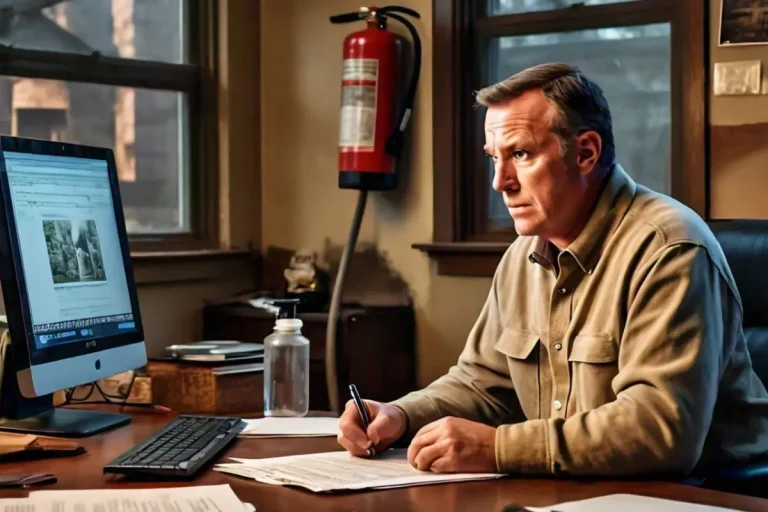

Once everyone is safe, get in touch with your fire insurance company right away. Let them know you need to file a fire damage claim. They will guide you on what to do next. Make sure to have your policy number ready. The insurance company will ask for details about the fire and the damage.

Be honest and provide as much information as you can. This will help speed up the fire damage claim process. They might send an adjuster to assess the damage. Keep all receipts for any emergency repairs you make. It is important to stay in contact with your insurance company throughout the process.

Document the Damage

After ensuring safety and contacting your insurance company, it’s crucial to document the damage. Take clear photos and videos of all affected areas. Make a detailed list of damaged items, including their descriptions and estimated values. This documentation will help support your claim and ensure you get fair compensation.

For those dealing with New Orleans fire damage, additional support and legal advice can be incredibly beneficial. Keeping thorough records will make the claims process smoother and faster.

Secure the Property

After documenting the damage, take steps to secure your home. Cover broken windows with plywood or plastic sheets. This will keep out rain and animals. Board up doors if needed to prevent theft.

If the roof has holes, use a tarp to cover them. These actions will protect your remaining belongings and prevent further damage. Notify your insurance company about any temporary repairs you make. Always keep receipts for any materials you buy.

Meet with the Adjuster

An adjuster will visit your home to assess the fire damage. Be ready to show the adjuster all the damage. Walk through the house with the adjuster. Point out all areas that were affected by the fire. Use your photos and list to make sure nothing is missed.

Answer any questions they have. The adjuster will make a report for the insurance company. This report will help decide the amount of your payout. Stay in touch with the adjuster until the process is finished.

Learn All About Fire Damage Insurance Claim

In conclusion, dealing with fire damage insurance claim isn’t as tough as you might think. Always stay calm and follow the steps. Make sure everyone is safe first. Then, call your insurance company and tell them what happened.

Take lots of pictures and videos of the damage. Protect your home from more damage. Keep talking to your insurance company and the adjuster. With some patience, you’ll get through this and get the help you need.

Visit our blog for more!